Chase & Amex Changes: Navigating A New Points Landscape

The travel rewards world is experiencing its biggest shake-up in a decade — and we want to make sure TravelWealth members are prepared.

Chase Overhauls Its Points Program

The Chase Sapphire Reserve launched in 2016 and revolutionized the points game. But after nearly a decade of stability, Chase announced sweeping changes to the card. You may have seen emails, articles, or social media posts celebrating new “enhancements” in the form of rebate credits and updated category multipliers. But let’s be clear: those sources make money when you click their links to apply for cards — and in this case, they are largely missing the mark with their assessment.

Here’s what’s really happening:

The annual fee is increasing from $550 to $795 — it’s now the most expensive personal card on the market.

The points-earning structure is more complicated and includes categories that are harder to track and less flexible. The generously broad “Travel” category on the card is now limited to Flights and Hotels, so you lose the bonus points on purchases including rental cars, cruises, Uber, Airbnb, TravelWealth membership, and more. In fairness, Flights and Hotels are moving from 3x to 4x – the extra points are nice, but that is more than offset by the other changes. Not to mention, there are other non-Chase card offerings that provide better and broader multipliers.

They’ve added a list of coupon-style credits (think: DoorDash, Instacart, Lyft) that look generous but are designed to go unused. Chase is betting that cardholders aren’t paying enough attention to apply these credits each month.

Most significantly, they’re slashing the baseline redemption value of points by 33%. This is a major devaluation, but they have masked it by shifting the focus to the other new (less valuable) features. Note: existing cardholders will not be impacted by this change until October 2027, so there is still a lot of time to plan ahead.

The new “Points Boost” feature is a largely disingenuous offering. Chase is touting this new feature as a way to get more value for your points, but it has two massive drawbacks:

1) It forces you to the user-unfriendly Chase Travel platform which frequently provides bad customer service, higher prices, and reservation management issues (the airlines won’t talk to you directly).

2) Based on our analysis, the “Points Boost” benefit is heavily favored toward booking United Airlines flights – this results in less flexibility and lower value when using your points on other carriers.

Chase will maintain some strategic advantage over the other programs thanks to its tight partnerships with United, Southwest, and Hyatt.

So yes, you may earn a few more points in certain categories, but those points will oftentimes be worth less and harder to use. And the negative impact is not limited to the Sapphire Reserve – these changes will trickle down to impact all Chase cards that earn Ultimate Rewards points. This isn’t an enhancement, it’s a devaluation with a PR spin.

American Express Won’t Let Chase Steal The Limelight

Not to be outdone, American Express announced that it’s making major changes to the Platinum and Business Platinum cards later this year. This will include the elimination of the 35% rebate on premium cabin flights — a benefit that has set Amex apart for many years. When that benefit goes, it reduces the baseline redemption value of Membership Rewards points for many cardholders. We have updated the Points Rankings below in anticipation of this change, though we are not yet sure when this update will take effect.

Additionally, we fully expect a higher annual fee (could they push all the way to $1,000?), some new frustrating monthly credits, and railroading cardholders to use the frustrating Amex Travel portal (which is operated by Expedia, so it has the issues as the Chase portal mentioned above). Naturally, this will be served with a round of marketing spin — but the net value will assuredly be a major decline.

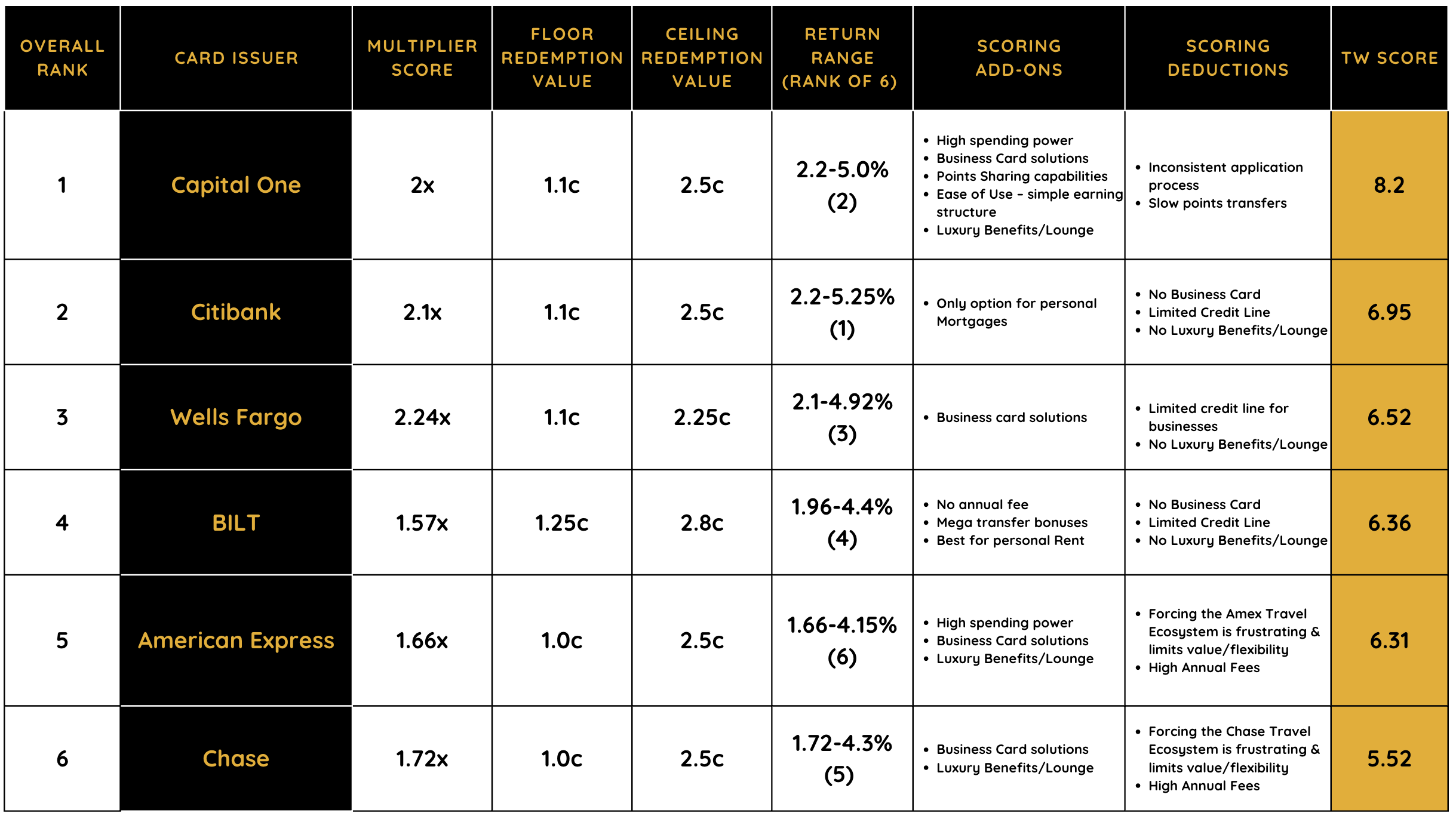

Our Updated Points Rankings

While Chase and Amex have stepped backwards, other programs continue to innovate and enhance the value and flexibility of their points. At TravelWealth, we can measure these programs by analyzing real data from our members’ spending habits and travel redemptions — these are not just blog headlines or credit card commercials. This analysis considers:

Multiplier categories and average member spend

Redemption values (min and max)

Ease of use and program flexibility

Access to large credit lines

Business card + personal card integration

Luxury perks like status and lounge access

Prior to these recent announcements, Chase and Amex had always ranked in the Top 3 spots (most recently, they were #2 and #3). But as you can see below, these new changes have dropped them to to the bottom of the list. Here are our most up-to-date scores and Power Rankings for the major credit card points programs:

5 years ago, these rankings were nearly reversed with Chase and American Express firmly ranked #1 and #2, while Capital One was at the bottom.

What Should You Do Now?

It’s not all bad news for Chase and Amex cardholders:

These programs still have advantages in certain aspects over the competition, be it their robust lounge networks or their partnerships with specific airlines (Chase + United or Amex + Delta).

They are also rank higher at #2 and #3 when only looking at Business Credit Cards.

It’s certainly possible that Chase and Amex are still a good option for you depending upon your spending and travel habits – they just are no longer the undisputed champions of the space.

If Chase or Amex are major players in your profile, this is the time to take action – not out of panic, but with intention. This is why we’re encouraging members to re-evaluate their card mix to determine if it makes sense to shift future spending toward another program. Please schedule a time with your Points Wealth Manager. – we’ll conduct a data-driven analysis of your current card profile, recommend changes to help you stay ahead of the curve, and maximize value every step of the way.